The Definitive Guide for Clark Wealth Partners

Table of ContentsExamine This Report about Clark Wealth PartnersWhat Does Clark Wealth Partners Mean?The Only Guide for Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyHow Clark Wealth Partners can Save You Time, Stress, and Money.Getting The Clark Wealth Partners To WorkLittle Known Facts About Clark Wealth Partners.Clark Wealth Partners for Dummies

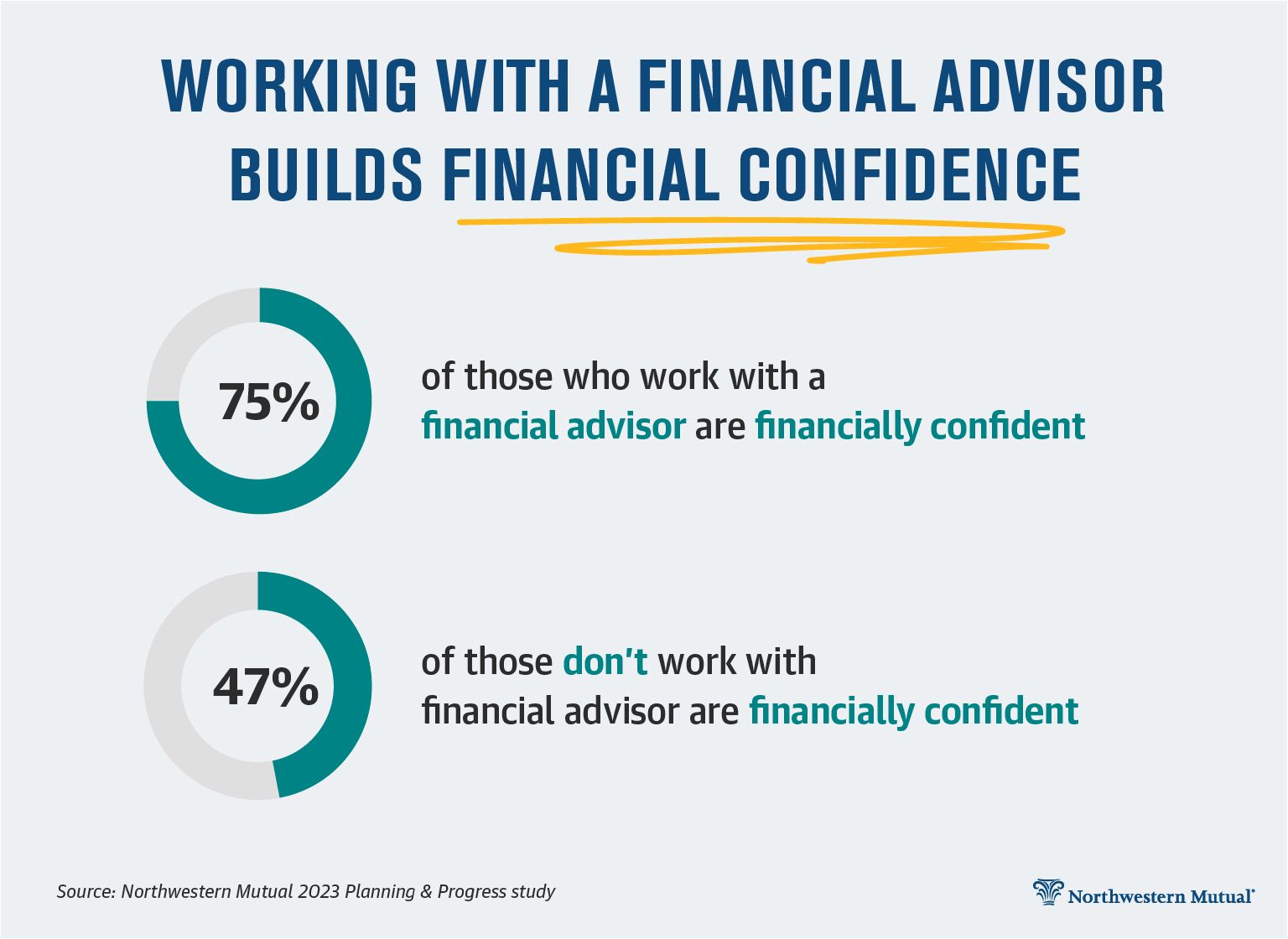

Common factors to consider a financial expert are: If your financial scenario has actually ended up being extra complex, or you do not have self-confidence in your money-managing abilities. Conserving or navigating significant life occasions like marital relationship, separation, children, inheritance, or job modification that might dramatically affect your monetary scenario. Browsing the shift from conserving for retirement to protecting wealth throughout retired life and exactly how to create a solid retired life revenue plan.New modern technology has actually brought about even more detailed automated economic tools, like robo-advisors. It's up to you to check out and identify the appropriate fit - https://www.robertehall.com/profile/blancarush6565041/profile. Inevitably, an excellent financial expert should be as conscious of your financial investments as they are with their own, staying clear of extreme charges, saving money on tax obligations, and being as clear as possible about your gains and losses

Getting My Clark Wealth Partners To Work

Gaining a payment on item referrals doesn't necessarily imply your fee-based consultant antagonizes your benefits. They may be extra likely to suggest products and solutions on which they earn a commission, which may or might not be in your best rate of interest. A fiduciary is legitimately bound to put their customer's passions.

This basic permits them to make referrals for financial investments and services as long as they match their customer's objectives, danger tolerance, and financial scenario. On the various other hand, fiduciary experts are legally obliged to act in their customer's best rate of interest instead than their very own.

Not known Facts About Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving right into intricate financial subjects, dropping light on lesser-known financial investment avenues, and discovering ways visitors can work the system to their advantage. As an individual money expert in her 20s, Tessa is acutely familiar with the influences time and unpredictability have on your financial investment decisions.

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

It was a targeted promotion, and it functioned. Review a lot more Read less.

The 6-Minute Rule for Clark Wealth Partners

There's no solitary path to ending up being one, with some people starting in banking or insurance coverage, while others begin in accountancy. 1Most economic organizers begin with a bachelor's level in money, business economics, accounting, company, or an associated topic. A four-year degree offers a solid foundation for jobs in financial investments, budgeting, and client services.

5 Simple Techniques For Clark Wealth Partners

Common instances include the FINRA Series 7 and Collection 65 exams for securities, or a state-issued insurance policy permit for marketing life or medical insurance. While credentials might not be lawfully needed for all planning roles, companies and customers typically watch them as a criteria of expertise. We check out optional credentials in the next area.

Most economic coordinators have 1-3 years of experience and knowledge with monetary products, conformity standards, and direct customer interaction. A solid instructional history is crucial, but experience shows the capability to use concept in real-world setups. Some programs integrate both, enabling you to finish coursework while making supervised hours through internships and practicums.

Our Clark Wealth Partners Diaries

Early years can bring lengthy hours, pressure to construct a client base, and the need to consistently verify your knowledge. Financial organizers take pleasure in the opportunity to work very closely with clients, guide vital life decisions, and often accomplish adaptability in routines or self-employment.

Riches supervisors can enhance their profits through compensations, possession costs, and performance bonuses. Monetary supervisors look after a group of financial coordinators and consultants, setting departmental technique, handling conformity, budgeting, and routing internal operations. They spent less time on the client-facing side of the industry. Almost all monetary supervisors hold a bachelor's level, and several have an MBA or comparable academic degree.

Not known Incorrect Statements About Clark Wealth Partners

Optional certifications, such as the CFP, generally require added coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Data, individual financial experts make an average yearly annual salary of $102,140, with leading earners gaining over $239,000.

In various other provinces, there are guidelines that need them to meet particular demands to use the economic advisor or economic planner titles (financial advisors Ofallon illinois). What establishes some monetary experts aside from others are education and learning, training, experience and qualifications. There are many classifications for financial advisors. For monetary coordinators, there are 3 typical classifications: Licensed, Individual and Registered Financial Organizer.

The 45-Second Trick For Clark Wealth Partners

Where to find an economic consultant will certainly depend on the kind of guidance you require. These institutions have team who might help you recognize and acquire specific types of financial investments.